Assistant Secretary of Commerce for Export Administration Thea Kendler held a briefing November 6 to discuss the rules issued October 17th.

She explained the new parameters, associated license requirements, the new notified advanced computing license exception, and some of the measures put into place to address possible circumvention of the controls.

(Her comments below have been edited for brevity).

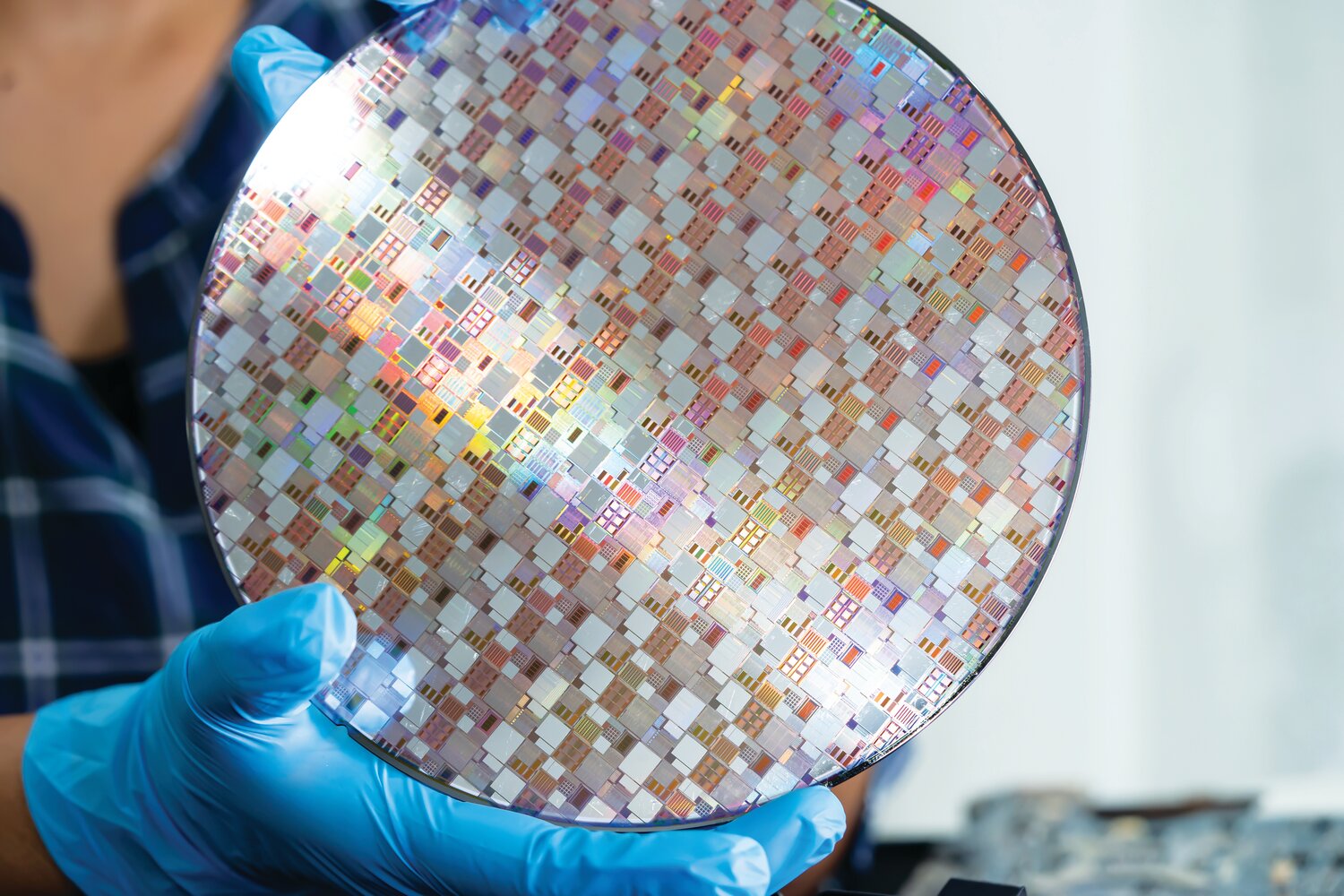

The rules we released on October 17th, consistent with last year's October 7th rule, respond to the concerns presented by the use of US advanced technology in China's military modernization efforts. Our controls focus on critical building block technologies for the supercomputing capacity sought by China. We're specifically restricting military and dual use items used to develop advanced artificial intelligence and other applications that will be critical to next generation military capabilities.

Advanced computing integrated circuits and supercomputing capacity are critical to improving the design and use of WMD's, advanced weapons systems, and high tech surveillance applications. In particular, advanced AI models trained on advanced computing integrated circuits can augment military decision making by improving speed, accuracy, planning, and logistics. China seeks to use advanced computing chips and supercomputing capacity in the development and deployment of these AI models to further its goal of surpassing the military capabilities the United States and its allies.

We have also seen massive advantage advances in frontier AI technology. Civil society, industry and government experts have been working to better understand the technologies we need to restrict to limit China's access to the dangerous absolute capabilities that could emerge from future AI models, and to maintain a relative AI advantage over China for military and national security purposes.

The updates announced on October 17th ensure our controls remain effective and narrowly targeted. But our policy intent has not changed at all. We continue to seek to target China's ability to acquire or produce the most advanced chips with direct AI applications for the development of advanced weapons systems, malicious cyber activity, and other military and intelligence applications. At the same time, we seek to minimize unintended impact on trade flows and on the economies of all.

The AI chips rule updates the restrictions put in place on advanced computing chips. Let me explain our new parameters, associated license requirements, the new notified advanced computing license exception, and some of the measures we're putting into place to address possible circumvention of our controls.

Thanks to the tremendous help of our Information Systems Technical Advisory Committee, we developed a more precise definition of total processing performance, or TPP. This new definition is based on a specific formula we set out in the rule.

Turning to circumstances in which licenses are required, the first thing to determine is whether it's designed or marketed for use in a data center. Generally, BIS expects that the manufacturer will know if it has designed or marketed its products for data center use. However, even if the manufacturer is not marketing the item for data center use, the item may be designed for data center use based on the technical characteristics of the item. If you're uncertain about an item, we encourage you to submit it for classification to BIS.

For non data center chips, the analysis hinges on TPP total processing performance of the chip. Once you've determined a chip is designed or marketed for data center use, we again start with TPP. If it's a high performance data center chip, you're going to need a license.

Licenses are also required to export, reexport and make in country transfers of restricted chips to entities that are headquartered in or whose ultimate parent company is headquartered in China or Macau. This is to prevent firms from countries of concern from securing controlled chips through their foreign subsidiaries and branches. These applications are also to be reviewed with a presumption of denial.

The rule creates new red flags and additional due diligence requirements to help foundries identify restricted chip designs from countries of concern. Our intent is to help foundries assess whether foreign parties are attempting to circumvent the controls by illicitly drawing them into fabbing restricted chips. This is one of the several topics on which we're specifically requesting written public comments. We are especially interested in the possibility of developing novel tools for scanning to distinguish AI chip designs from other designs. It's our understanding that these scans are technically feasible and could significantly strengthen foundries’ due diligence efforts without revealing sensitive information about a given design.

We'll now turn to the semiconductor manufacturing equipment or SME rule that was released on October 17th, updating our October 7th, 2022 controls. While the AI chip rule controls advanced integrated circuits, the SME rule controls the items that are used to develop advanced chips

Our controls on AI chips themselves will not be effective unless they are complemented by effective controls on the equipment required to make these chips. Thus, our SME controls flow from the same national security and human rights concerns that motivate our AI. Controls.

The Commerce Department Bureau of Industry and Security recognizes that as a leader in the SME industry, the United States plays a critical role when it comes to regulating the next increment of semiconductor development. We do so by controlling the export of critical SME and associated development and production technology and software, as well as activities of US persons that support such. Semi development and production in countries of concern.

We'll cover the five major changes to the October 7th world that are in our October 17th iteration.

First, the rule imposes new controls on several types of advanced SME's and revises others that were formerly captured in ECCN 3BO9O. The new and revised SME controls span lithography, deposition, etch, cleaning and inspection tools, among other types of equipment used to produce advanced node chips.

The Commerce Department also updated Category 3D and three EEC's to capture software and technology related to these new and revised Category 3B controls.

The rule also expands the license requirements for SME to apply to additional countries beyond the China and Macau to all of the destinations for which the US maintains an arms embargo, the country group D5 destinations we described earlier, as well as Macau.

The rule does this by imposing new national security controls in addition to the regional. Stability controls that previously applied to 3BO9O and related ECN's. We expanded the country scope of the SME controls because we're concerned about risk of diversion. Adding a license requirement for destinations in country Group D5 and Macau addresses that concern and gives us visibility into the flow of SME and associated items.

In each case, the new and revised controls cover both equipment as well as specially designed components and accessories for that equipment. For this reason, it's especially important that component suppliers to SME companies worldwide review and understand how these controls may apply to their products, especially with respect to SME. Produced in China or Macau and other D5 countries.

Second, the rule refines and better focuses the US person restrictions and it reformats the existing controls to make them easier to follow. It does not add new US person controls. Most notably, we are excluding certain natural persons individuals from the scope of the advanced IC and SME production controls, the individuals excluded are those who are employed by companies headquartered in the United States and partner destinations, meaning country groups A5 or A6.

But if the company the individual is working for or on behalf of is majority owned by an entity that's headquartered. In country group D5, including China or in Macau, the exclusion isn't available. We took this step to ease the compliance burden and corresponding disincentive to employ US person individuals, while still comprehensively regulating the activities of US entities in support of these and uses in addition.

Third, the rule expands the scope of end use controls for advanced chip production facilities to include additional facilities that support advanced node IC production. For example, the term production better captures facility where related product engineering or other manufacturing activities may occur. But at which volume production does not yet or may never occur.

BIS has received many questions about the types of activities covered by production versus Fabricate and we plan to address these questions in subsequent published guidance.

Fourth, We revised and clarified the license review policies for the end use controls in 744.6 and 744.23 of the Export Administration Regulations to focus the scope of the presumption of denial on activities and items of greatest concern.

We adopted A presumption of approval for end users headquarters in the United States or in country group A5 or A6 provided the end user isn't majority owned by an entity headquartered in AD 5 country including China or Macau. We also adopted a presumption of denial for items destined to D5 country or Macau, but a presumption of approval where there is a foreign made item available that's not subject to EAR controls and performs the same function as an item that is subject to the controls.

For all other applications, BIS will review licenses on a case by case basis. In each case, the license review will take into account factors including technology level, customers and compliance plans.

Fifth, The rule adds a temporary general license related to the SME production and use control. The SME Production and Use Control now restricts the provision of all Commerce Control listed Commerce Control List listed items destined for the development or production of front end IC production equipment and related parts and components captured in specified ECCNs in country Group D5 or Macau.

The Commerce Department previously issued temporary authorizations to prevent supply chain disruptions and has addressed this issue in the rule with a new Temporary General License, or TGL. The items at issue must be specified on the Commerce Control List and controlled only for anti terrorism reasons. And finally, the TGL cannot be used for indigenous development or production of Covered SME's and it does not overcome the license requirements of the Entity List or any other end use or end user provisions. The purpose of the TGL is to allow SME producers in the United States and allied countries partner countries additional time to, for example, identify alternative sources of supply for their less restricted SME items.

The rules identify several specific issues on which we would benefit from hearing from you. The topics include the following.

First, we want industries input on the scope and specifications of the new three BO1 and three BO2 ECM's on SMA. Here it would be very helpful if public comments could identify. Other US manufactured and foreign manufactured items that may also warrant control with respect to each of the three types of advanced node integrated circuits defined in the rule, among others, and to identify specific examples of foreign available alternatives or backfilling where relevant.

Similarly, we welcome feedback on specific items or activities that should or should not fall within the scope of BIS. And use restrictions and related exclusions such as the back end exclusion in light of the policies we've outlined in the preamble and in today's briefing.

Second, we'd like to learn the details of the potential impact of a deemed export and deemed reexport requirement for technology related to the new 3B ECM's. In the context of these comments, we hope to learn more about industries practices for safeguarding technology and intellectual property, as well as the role for foreign person employees in obtaining and maintaining US technology leadership.

Third, we welcome input on the potential for new regulations that would help identify whether a customer of a cloud computing provider is developing or producing a dual use AI foundation model. Many of you are likely aware of the recent executive Order on AI which requires the Department of Commerce to collect data on certain large scale AI. Training runs That activity is unrelated to our request for public comment through this rulemaking, although our request for comment and our AI executive order work relates to the same overall topic, better understanding access to AI chips through the cloud for developers of Frontier Scale AI models.

Fourth It would be helpful to receive descriptions of any proposed technical solutions that could limit items specified under ECCN3AO9O or 4AO9O from enabling training of large dual use AI foundation models for capabilities of concern such as weapons modeling. Our current controls focus on limiting the capabilities of individual chips. But the capabilities we are concerned with can also be achieved by networking many such chips together. We want your help identifying technical solutions that could place hard limits on the number of chips in a network.

Fifth As we covered earlier, we would like input on our broad approach to the concepts of parent, majority owned and headquartered companies, particularly as it may relate to the ability of exporters to access the information required to assess the status of a foreign party and any other access that would limit the ability to comply with those restrictions.

We request comments on how to more precisely define key terms and parameters in our regulations. This includes, among others, the technical parameters included in the definition of supercomputer and whether the definition of supercomputer may result increasingly in commercial data centers falling under the definition and the end use control.

More broadly, we're also asking for comment on regulatory methods, industry impact, new approaches for limiting the use of chips for AI supercomputing, and scope for possible cloud notification requirements or controls.

Publicly published comments as well as unpublished business confidential comments are due by December 18th of this year.

Comments

No comments on this item Please log in to comment by clicking here